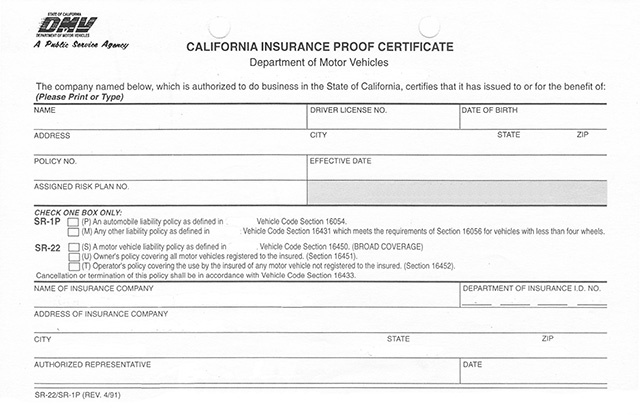

An operator's- owner's certification covers all lorries owned and run by the motorist. A vehicle driver that has an automobile but also drives unowned vehicles (such as a firm cars and truck) may use this type of SR-22 certificate. When Is an SR-22 Needed?

Just how Lengthy Is the SR-22 Certification Need? The period of the SR-22 insurance requirement varies from one to five years. When the requirement starts and also the length of time it lasts depends upon state regulation and also the reason the driver is required to have the SR-22 certification. For example, if a vehicle driver is needed to have SR-22 insurance coverage because of a conviction that carries a motorist's permit suspension, the need could start on the date of the crime, conviction, or suspension.

What Does Sr22 Dui Insurance: What You Need To Know Do?

And if the jurisdiction calls for an SR-22 to acquire a hardship or probationary authorization, the demand typically begins on the day the driver obtains the permit. How Much Does an SR-22 Certification Cost? There's generally a cost of $15 to $30 to file an SR-22 certificate. Nonetheless, the underlying sentence or reason a driver is needed to have the SR-22 typically results in additional expenses for the driver.

As long as the motorist maintains the SR-22 during the suspension period, the suspension is inactive and also the driver can drive. However, if the vehicle driver stops working to maintain the SR-22, the suspension reactivates and also restarts from the first day of the original suspension. In other states, motorists must keep SR-22 insurance coverage for a specific time period adhering to a certificate suspension.

Some Known Factual Statements About What Is Sr-22 Insurance And What Does It Do? - Allstate

Some states call for motorists to get SR-22 insurance complying with a certificate suspension as a requirement to certify reinstatement. In these territories, drivers who fall short to get SR-22 insurance aren't eligible for permit reinstatement at the end of the suspension period. In jurisdictions where vehicle drivers have to keep an SR-22 continuously for a specified time duration, any kind of gap of protection results in the SR-22 demand re-starting from the get go of the required time duration.

A chauffeur's license can be revoked or suspended when one sheds a DMV hearing or if one is not requested. A court sentence on DUI fees can also result in a suspension or revocation of a driver's license. When either of these takes place, you will certainly have to file an SR22 to recover your driving entitlement.

The The Comprehensive Guide On Sr22 - Sr22 Insurance Diaries

You may either obtain an Ignition Interlock Gadgets limited license, or a regular limited driver's license. The gadget enables the specific whose license has actually been suspended to drive to any type of part of the state till he or she completes the suspension period.

The insurance provider will certainly either send the certificate to the DMV or terminate the insurance coverage policy. If you are released with an SR22 certificate by your insurance company, your insurance rates will average car insurance cost certainly more than likely increase. The type will be straight online filed with the DMV, and also you do not have to offer them yourself.

More About Suspended Driver's License? You May Need An Sr-22 - State ...

Your new insurer will likely ask you to make payments for a higher premium, as automobile insurance provider might now consider you an at-risk chauffeur. In The golden state, it is illegal to drive an automobile without car insurance. So the state of The golden state obtains you enrolled with a program that discovers ideal insurance coverage carriers for you.

Insurance provider do not make a judgment about raising your plan by thinking about only the aspect of DUI conviction. The majority of insurance provider may additionally consider your age, driving experience, driving background, connection status, and also residence. Comparable to various other car insurance coverage, the costs for California SR22 vary by business. You must prepare to spend a quantity anywhere in between $300 and $800 for an insurance plan.

The 2-Minute Rule for How To Get Your License Back With Sr-22 Insurance ...

Along with the costs, you will certainly more than likely shed your vehicle driver insurance policy price cut, as it is restricted for DUI offenders to retain or get the discount rate for 10 years after your DUI crime. As an SR-22 client, you may be asked to pay a high worth for the responsibility insurance policy required in California since you are now considered an at-risk vehicle driver.